With enthusiasm, let’s navigate through the intriguing topic related to 5 Crucial Factors to Consider When Choosing the Ultimate Forex Trading Platform: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The world of Forex trading is a dynamic and exciting one, offering the potential for significant profits. But navigating this complex market requires a reliable and user-friendly platform. With countless options available, choosing the best forex site can feel overwhelming.

This comprehensive guide will equip you with the knowledge to make an informed decision, delving into five crucial factors that separate the exceptional platforms from the rest.

1. Security and Regulation:

Security is paramount in the world of online trading. Your funds and personal information must be protected at all times. Look for platforms that are:

- Regulated: A regulated platform operates under the watchful eye of a financial authority, ensuring adherence to strict standards and providing a layer of protection for traders. Reputable regulators include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Commodity Futures Trading Commission (CFTC) in the United States.

- Secure: Ensure the platform uses advanced encryption technology (like SSL) to safeguard your data during transactions. Look for features like two-factor authentication and secure login processes.

2. Trading Features and Tools:

- Trading Instruments: The platform should offer a wide range of tradable assets, including major, minor, and exotic currency pairs, as well as commodities, indices, and cryptocurrencies.

- Order Types: A variety of order types (market, limit, stop-loss, take-profit) allow for flexible trading strategies and risk management.

- Trading Platforms: Choose a platform that offers both desktop and mobile versions for convenient access anytime, anywhere.

- Educational Resources: Look for platforms that provide educational materials, webinars, and tutorials to help you learn and refine your trading skills.

3. Spreads and Fees:

Trading costs play a significant role in profitability. Consider these factors:

4. Customer Support:

Reliable customer support is essential, especially when encountering technical issues or needing assistance with platform features. Look for platforms that offer:

- Multiple Channels: Access to customer support via phone, email, live chat, and FAQs.

- Prompt Response Times: Fast and efficient responses to inquiries.

- Helpful and Knowledgeable Representatives: Agents who can provide clear and accurate information.

5. User Experience and Platform Usability:

A user-friendly interface is crucial for a seamless trading experience. Consider these factors:

- Intuitive Design: The platform should be easy to navigate, with clear menus and intuitive features.

- Customization Options: The ability to personalize charts, layouts, and settings for a tailored experience.

- Mobile App Functionality: A robust and responsive mobile app that mirrors the desktop platform’s features.

Top Forex Platforms: A Comparative Analysis

Let’s examine some of the leading forex platforms based on the criteria discussed above:

1. MetaTrader 4 (MT4):

- Pros: Industry standard, highly customizable, advanced charting tools, vast library of indicators, wide range of brokers offering MT4.

- Cons: Can be complex for beginners, limited mobile app functionality compared to MT5.

2. MetaTrader 5 (MT5):

- Pros: More advanced than MT4, offers economic calendar, depth of market information, wider range of order types, improved mobile app.

- Cons: Steeper learning curve, not as widely available as MT4.

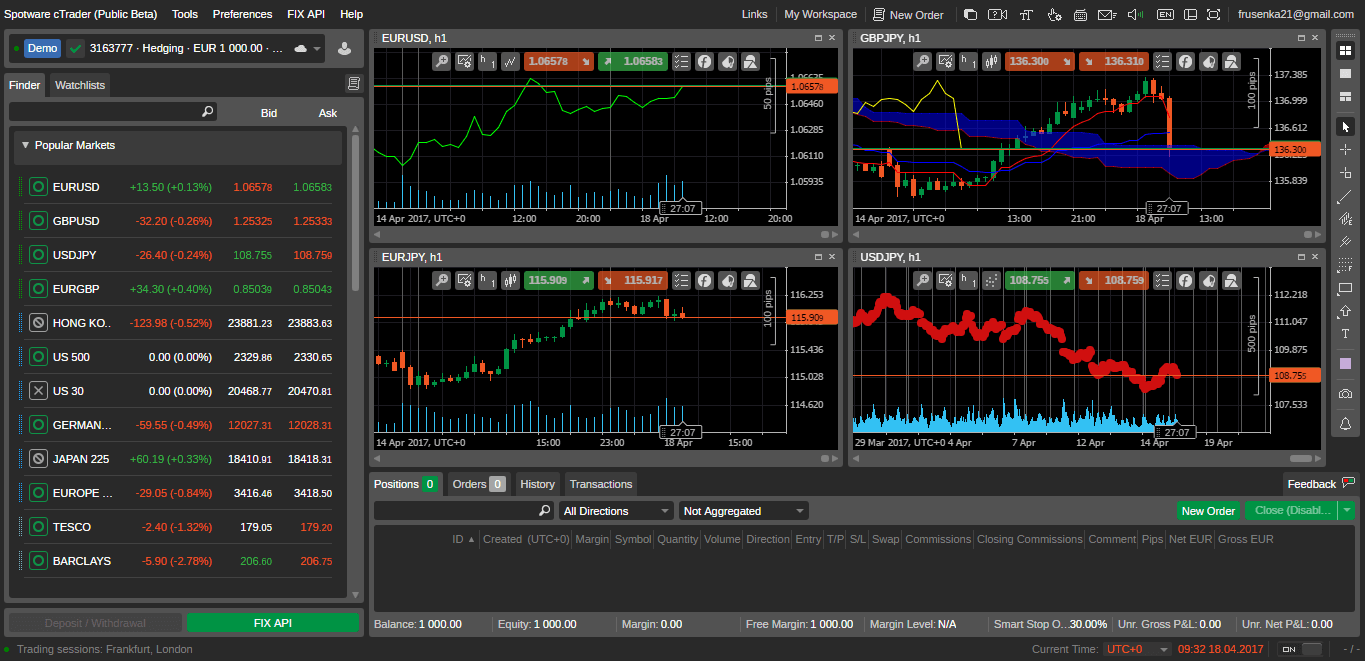

3. cTrader:

- Pros: Fast order execution, advanced charting and analysis tools, user-friendly interface, comprehensive mobile app.

- Cons: Limited broker availability, fewer educational resources compared to MT4 and MT5.

4. TradingView:

- Pros: Powerful charting and analysis platform, social trading features, extensive library of indicators and strategies, free and paid plans.

- Cons: Not a full-fledged trading platform, requires integration with a broker for live trading.

5. eToro:

- Pros: User-friendly interface, social trading features, copy trading functionality, educational resources, wide range of instruments.

- Cons: Higher spreads compared to some platforms, limited advanced charting tools.

Choosing the Right Platform for Your Needs:

The best forex platform for you depends on your individual trading style, experience level, and specific requirements.

- Beginners: Look for platforms with user-friendly interfaces, educational resources, and demo accounts for practice.

- Experienced Traders: Seek platforms with advanced charting tools, multiple order types, and fast order execution.

- Scalpers: Prioritize platforms with low spreads and fast order execution.

- Swing Traders: Focus on platforms with strong charting and analysis tools and a variety of technical indicators.

Final Thoughts:

Choosing the right forex platform is a crucial step towards success in the Forex market. By carefully considering the five factors outlined in this guide, you can make an informed decision and select a platform that empowers you to trade confidently and efficiently. Remember to prioritize security, user experience, and trading tools that align with your individual needs and trading style.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Trading Forex carries significant risk and may not be suitable for all investors. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

4. Customer Support:

Reliable customer support is essential, especially when encountering technical issues or needing assistance with platform features. Look for platforms that offer:

- Multiple Channels: Access to customer support via phone, email, live chat, and FAQs.

- Prompt Response Times: Fast and efficient responses to inquiries.

Closure

Thus, we hope this article has provided valuable insights into 5 Crucial Factors to Consider When Choosing the Ultimate Forex Trading Platform: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!