In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Powerful Forex Options Trading Platforms: Unlocking Profit Potential. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The forex market, the world’s largest and most liquid financial market, offers traders a vast array of opportunities to profit from currency fluctuations. While traditional forex trading involves buying and selling currencies directly, forex options trading presents a unique and potentially powerful way to participate in this dynamic market.

Forex options contracts grant the right, but not the obligation, to buy or sell a specific currency at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility allows traders to manage risk and potentially generate significant profits, even in volatile market conditions.

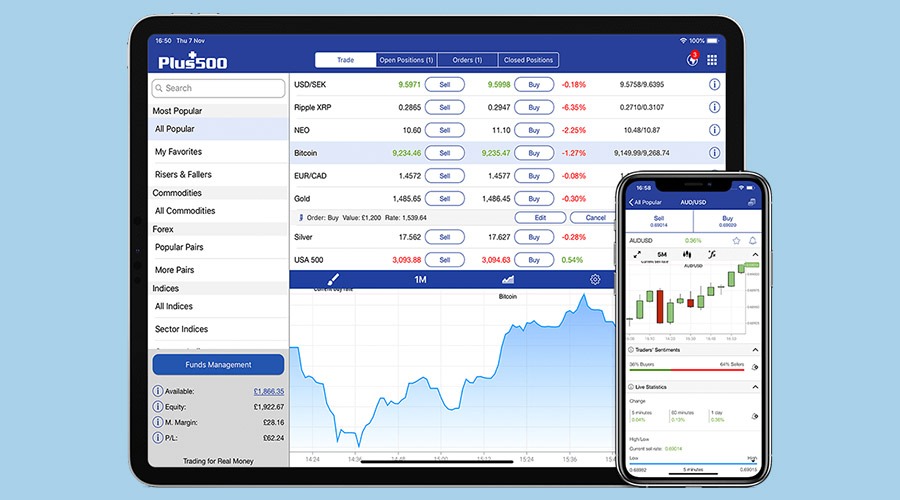

To navigate the intricacies of forex options trading, traders need reliable and user-friendly platforms that provide access to real-time market data, advanced charting tools, and a wide range of order types. This article will explore five powerful forex options trading platforms that cater to different trading styles and experience levels.

1. MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 (MT4) is widely considered the industry standard for forex trading, and its popularity extends to options trading as well. This platform offers a robust set of features, including:

- Real-time market data: MT4 provides access to live quotes from multiple liquidity providers, ensuring accurate and up-to-date information.

- Advanced charting tools: The platform offers a comprehensive suite of technical indicators, drawing tools, and customizable chart layouts for in-depth market analysis.

- Multiple order types: MT4 supports a variety of order types, including market orders, limit orders, stop orders, and trailing stops, allowing traders to execute trades precisely and manage risk effectively.

- Mobile trading: The MT4 mobile app provides on-the-go access to trading accounts, market data, and charting tools.

Advantages:

- Robust functionality: The platform offers a comprehensive set of features for both technical and fundamental analysis, catering to a wide range of trading styles.

- Customization: MT4’s user interface is highly customizable, allowing traders to personalize the platform to their specific needs and preferences.

Disadvantages:

2. MetaTrader 5 (MT5): The Next Generation

MetaTrader 5 (MT5) is the successor to MT4, offering a more advanced and feature-rich platform with enhanced options trading capabilities. Some key improvements include:

- Expanded order types: MT5 supports a wider range of order types, including market orders, limit orders, stop orders, trailing stops, and pending orders.

- Advanced risk management tools: The platform offers sophisticated risk management tools, including stop-loss orders, take-profit orders, and trailing stops, to help traders protect their capital.

- Economic calendar: MT5 provides an integrated economic calendar, allowing traders to stay informed about upcoming economic events that could impact market volatility.

- Depth of Market (DOM): The platform displays the Depth of Market (DOM), which provides insights into the order book and helps traders understand market liquidity.

Advantages:

- Improved options trading features: MT5 offers more advanced options trading tools compared to MT4, including the ability to trade both European and American options.

- Enhanced charting capabilities: MT5 provides a wider range of technical indicators, drawing tools, and customizable chart layouts, offering greater flexibility for market analysis.

- Advanced risk management: The platform’s comprehensive risk management tools help traders manage their exposure and protect their capital.

Disadvantages:

- Steeper learning curve: MT5’s advanced features can be more challenging to learn and master than MT4.

- Limited broker support: While MT5 is gaining popularity, it is not as widely supported by brokers as MT4.

3. Thinkorswim: Powerful Options Trading Platform

Thinkorswim is a popular trading platform developed by TD Ameritrade, known for its intuitive interface and comprehensive options trading features. Key features include:

- Advanced charting tools: Thinkorswim provides a wide range of charting tools, including technical indicators, drawing tools, and customizable chart layouts, for in-depth market analysis.

- Options trading strategies: The platform offers a variety of pre-built options trading strategies, including covered calls, cash-secured puts, and iron condors, to help traders implement complex trading plans.

- Interactive analysis: Thinkorswim’s interactive analysis tools allow traders to visualize and analyze options strategies, including profit/loss diagrams, Greeks, and probability of profit.

- Paper trading: The platform provides a paper trading account, allowing traders to practice their options trading strategies in a risk-free environment.

Advantages:

- User-friendly interface: Thinkorswim’s intuitive design makes it easy to navigate and use, even for novice traders.

- Comprehensive options trading features: The platform offers a wide range of tools and resources specifically designed for options trading, including strategy builders, analysis tools, and educational content.

- Paper trading: Thinkorswim’s paper trading account allows traders to practice their options trading strategies without risking real capital.

Disadvantages:

- Limited forex options: While Thinkorswim offers a comprehensive suite of options trading tools, its forex options offerings are relatively limited compared to other platforms.

- Brokerage fees: TD Ameritrade charges brokerage fees for trading options, which can add up over time.

4. TradeStation: Sophisticated Platform for Experienced Traders

TradeStation is a powerful trading platform designed for experienced traders, offering advanced charting tools, real-time market data, and sophisticated order types. Some notable features include:

- Real-time streaming data: TradeStation provides access to real-time market data from multiple exchanges, ensuring accurate and up-to-date information.

- Advanced charting tools: The platform offers a comprehensive suite of technical indicators, drawing tools, and customizable chart layouts for in-depth market analysis.

- Multiple order types: TradeStation supports a wide range of order types, including market orders, limit orders, stop orders, and trailing stops, allowing traders to execute trades precisely and manage risk effectively.

- Backtesting and optimization: TradeStation’s backtesting and optimization tools allow traders to test and refine their trading strategies using historical data.

Advantages:

- Powerful charting and analysis tools: TradeStation’s advanced charting and analysis tools provide a comprehensive suite of features for technical and fundamental analysis.

- Sophisticated order types: The platform supports a wide range of order types, allowing traders to execute trades with precision and manage risk effectively.

- Backtesting and optimization: TradeStation’s backtesting and optimization tools allow traders to test and refine their trading strategies using historical data.

Disadvantages:

- Steep learning curve: TradeStation’s advanced features can be overwhelming for novice traders, requiring a significant learning curve to master the platform.

- Higher fees: TradeStation charges higher brokerage fees compared to some other platforms, which can be a significant consideration for active traders.

5. Interactive Brokers: Global Brokerage with Extensive Options Offerings

Interactive Brokers is a global brokerage firm that offers a powerful trading platform with a wide range of options trading features. Some key features include:

- Global market access: Interactive Brokers provides access to a vast array of global markets, including forex, equities, futures, and options.

- Multiple trading platforms: The firm offers a choice of trading platforms, including TWS (Trader Workstation) and IBKR Mobile, catering to different trading styles and preferences.

- Advanced order types: Interactive Brokers supports a wide range of order types, including market orders, limit orders, stop orders, and trailing stops, allowing traders to execute trades precisely and manage risk effectively.

- Real-time market data: Interactive Brokers provides access to real-time market data from multiple exchanges, ensuring accurate and up-to-date information.

Advantages:

- Global market access: Interactive Brokers provides access to a vast array of global markets, offering traders a wide range of trading opportunities.

- Multiple trading platforms: The firm offers a choice of trading platforms, catering to different trading styles and preferences.

- Advanced order types: Interactive Brokers supports a wide range of order types, allowing traders to execute trades with precision and manage risk effectively.

- Competitive pricing: Interactive Brokers offers competitive pricing and low brokerage fees, making it an attractive option for active traders.

Disadvantages:

- Complex platform: Interactive Brokers’ trading platforms can be complex and require a significant learning curve to master.

- Limited customer support: Interactive Brokers’ customer support can be difficult to reach and may not be as responsive as some other brokers.

Conclusion: Choosing the Right Forex Options Trading Platform

The best forex options trading platform for you will depend on your individual needs and trading style. Consider factors such as:

- Trading experience: Novice traders may prefer platforms with user-friendly interfaces and comprehensive educational resources, while experienced traders may seek platforms with advanced charting tools, backtesting capabilities, and sophisticated order types.

- Trading style: Scalpers and day traders may prioritize platforms with fast execution speeds and real-time market data, while swing traders and long-term investors may focus on platforms with advanced charting tools and backtesting capabilities.

- Budget: Brokerage fees and account minimums can vary significantly between platforms, so it’s important to consider your budget and trading activity.

- Features: Different platforms offer different features, such as options trading strategies, analysis tools, and risk management tools.

By carefully evaluating your needs and preferences, you can choose the powerful forex options trading platform that empowers you to unlock your profit potential in the dynamic world of currency trading.

2. MetaTrader 5 (MT5): The Next Generation

MetaTrader 5 (MT5) is the successor to MT4, offering a more advanced and feature-rich platform with enhanced options trading capabilities. Some key improvements include:

- Expanded order types: MT5 supports a wider range of order types, including market orders, limit orders, stop orders, trailing stops, and pending orders.

- Advanced risk management tools: The platform offers sophisticated risk management tools, including stop-loss orders, take-profit orders, and trailing stops, to help traders protect their capital.

- Economic calendar: MT5 provides an integrated economic calendar, allowing traders to stay informed about upcoming economic events that could impact market volatility.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Forex Options Trading Platforms: Unlocking Profit Potential. We thank you for taking the time to read this article. See you in our next article!