With great pleasure, we will explore the intriguing topic related to 5 Killer Forex Trading Platforms: Unlocking Your Trading Potential. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

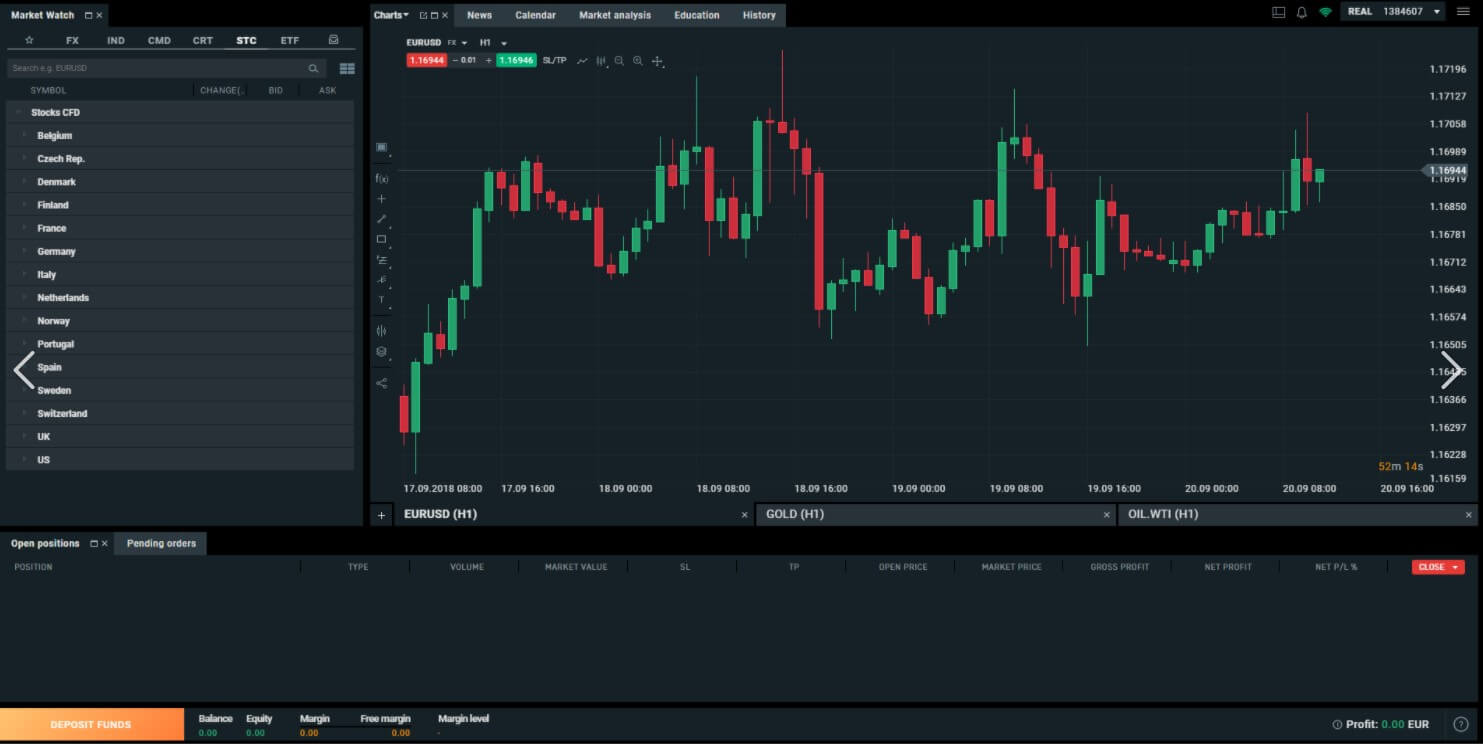

The forex market is a dynamic and exciting space, offering traders the opportunity to profit from global currency fluctuations. However, navigating this complex landscape requires the right tools. Choosing the best forex trading platform is crucial, as it will be your gateway to accessing the market, executing trades, and managing your portfolio.

With so many platforms vying for your attention, it can be overwhelming to decide which one suits your needs. This article will delve into five of the most popular and powerful forex trading platforms, examining their strengths, weaknesses, and suitability for different trader profiles.

1. MetaTrader 4 (MT4)

A true industry veteran, MetaTrader 4 (MT4) has been a staple in the forex trading world since 2005. Its widespread adoption stems from its user-friendly interface, powerful charting capabilities, and robust automated trading features.

Strengths:

- Intuitive interface: MT4 is known for its simplicity and ease of use, making it accessible to both beginners and experienced traders.

- Advanced charting tools: The platform offers a wide range of technical indicators, drawing tools, and charting styles, allowing for in-depth market analysis.

- Expert Advisors (EAs): MT4’s automated trading capabilities allow traders to set up pre-programmed trading strategies, freeing them from the need to constantly monitor the market.

- Widely available: MT4 is supported by a vast network of brokers, making it easily accessible to traders worldwide.

Weaknesses:

- Outdated technology: MT4 is now showing its age compared to newer platforms with more advanced features.

- Security concerns: MT4 has faced security vulnerabilities in the past, although these have been addressed with updates.

Ideal for:

2. MetaTrader 5 (MT5)

The successor to MT4, MetaTrader 5 (MT5), builds upon the strengths of its predecessor while introducing new features and functionalities.

Strengths:

- Enhanced charting tools: MT5 offers a wider range of technical indicators, drawing tools, and timeframes than MT4.

- Advanced order types: MT5 supports a wider range of order types, including pending orders and market orders, providing greater flexibility in trade execution.

- Economic calendar: The platform includes an integrated economic calendar, keeping traders informed of upcoming economic events that can impact market volatility.

- Multiple trading accounts: MT5 allows traders to open and manage multiple trading accounts from a single platform.

Weaknesses:

- Steeper learning curve: MT5’s advanced features can be overwhelming for new traders.

- Limited broker support: Compared to MT4, MT5 is supported by a smaller number of brokers.

- Higher resource requirements: MT5 requires more computing power than MT4, potentially affecting performance on older computers.

Ideal for:

- Experienced traders: MT5’s advanced features and trading tools are ideal for seasoned traders looking for greater control and flexibility.

- Long-term traders: The platform’s comprehensive market analysis tools and economic calendar are beneficial for long-term trading strategies.

- Multi-asset traders: MT5 supports trading in multiple asset classes, including stocks, futures, and options, in addition to forex.

3. cTrader

cTrader is a relatively new platform gaining popularity for its lightning-fast execution speeds and advanced order management features.

Strengths:

- Ultra-fast execution: cTrader boasts some of the fastest execution speeds in the industry, ideal for scalping and high-frequency trading.

- Depth of market (DOM): The platform displays the full order book, providing traders with a real-time view of market liquidity and order flow.

- Advanced order management: cTrader offers a wide range of order types, including stop-loss orders, take-profit orders, and trailing stops, for greater risk management.

- Customizable interface: Traders can personalize their trading environment with different layouts, themes, and color schemes.

Weaknesses:

- Limited charting tools: While cTrader offers basic charting tools, they are not as comprehensive as those found in MT4 or MT5.

- Smaller broker network: cTrader is supported by a smaller number of brokers compared to other platforms.

- Steeper learning curve: The platform’s advanced features and complex interface can be challenging for new traders.

Ideal for:

- Scalpers and high-frequency traders: cTrader’s ultra-fast execution speeds and depth of market make it ideal for short-term trading strategies.

- Experienced traders: The platform’s advanced order management features and customization options cater to seasoned traders.

- Institutional traders: cTrader’s robust features and high-speed execution are attractive to institutional investors.

4. TradingView

TradingView is a unique platform that has gained immense popularity among traders, particularly for its powerful charting tools and social trading features.

Strengths:

- Exceptional charting tools: TradingView offers a wide range of technical indicators, drawing tools, and charting styles, making it an excellent platform for technical analysis.

- Social trading: The platform allows traders to share their ideas, charts, and trading strategies with other users, fostering a collaborative trading environment.

- Real-time data: TradingView provides real-time market data from multiple sources, ensuring traders have access to the latest information.

- Multiple asset classes: The platform supports trading in multiple asset classes, including forex, stocks, futures, and cryptocurrencies.

Weaknesses:

- Limited trading functionality: While TradingView offers excellent charting tools, its trading functionality is limited.

- No direct access to the market: Traders need to connect TradingView to a broker account to execute trades.

- Subscription fees: TradingView offers a free plan with limited features, while advanced features require a paid subscription.

Ideal for:

- Technical analysts: TradingView’s powerful charting tools and real-time data are ideal for traders who rely on technical analysis.

- Social traders: The platform’s social trading features allow traders to connect with other traders and share their ideas.

- Beginner traders: TradingView’s free plan provides access to basic charting tools and market data, making it a good option for new traders.

5. NinjaTrader

NinjaTrader is a popular platform known for its advanced order management features, customizable interface, and powerful charting capabilities.

Strengths:

- Advanced order management: NinjaTrader offers a wide range of order types, including stop-loss orders, take-profit orders, and trailing stops, for greater risk management.

- Customizable interface: Traders can personalize their trading environment with different layouts, themes, and color schemes.

- Powerful charting tools: NinjaTrader offers a wide range of technical indicators, drawing tools, and charting styles, making it an excellent platform for technical analysis.

- Automated trading: The platform supports automated trading with its Strategy Analyzer and backtesting capabilities.

Weaknesses:

- Steeper learning curve: NinjaTrader’s advanced features and customizable interface can be challenging for new traders.

- Higher resource requirements: NinjaTrader requires more computing power than other platforms, potentially affecting performance on older computers.

- Limited broker support: NinjaTrader is supported by a smaller number of brokers compared to other platforms.

Ideal for:

- Experienced traders: NinjaTrader’s advanced features and customization options cater to seasoned traders.

- Automated traders: The platform’s Strategy Analyzer and backtesting capabilities allow traders to develop and test automated trading strategies.

- Active traders: NinjaTrader’s powerful charting tools and order management features are ideal for active traders who execute multiple trades daily.

Choosing the Right Platform

The best forex trading platform for you will depend on your individual needs and trading style. Consider the following factors:

- Trading experience: Beginners may prefer platforms with intuitive interfaces and educational resources, while experienced traders may benefit from platforms with advanced features and customization options.

- Trading style: Scalpers and high-frequency traders may prioritize platforms with fast execution speeds and depth of market, while long-term traders may value platforms with comprehensive market analysis tools and economic calendars.

- Budget: Some platforms offer free plans with limited features, while others require paid subscriptions for full functionality.

- Broker support: Ensure the platform is supported by a reputable broker that offers competitive trading conditions.

Conclusion

The forex trading landscape is constantly evolving, with new platforms emerging and existing platforms improving their offerings. The five platforms discussed in this article represent some of the most popular and powerful choices available today. By carefully considering your individual needs and trading style, you can select the best platform to unlock your trading potential and navigate the exciting world of forex trading.

2. MetaTrader 5 (MT5)

The successor to MT4, MetaTrader 5 (MT5), builds upon the strengths of its predecessor while introducing new features and functionalities.

Strengths:

- Enhanced charting tools: MT5 offers a wider range of technical indicators, drawing tools, and timeframes than MT4.

Closure

Thus, we hope this article has provided valuable insights into 5 Killer Forex Trading Platforms: Unlocking Your Trading Potential. We appreciate your attention to our article. See you in our next article!