In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Ultimate Weapon: 5 Forex Hedges to Safeguard Your Profits. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

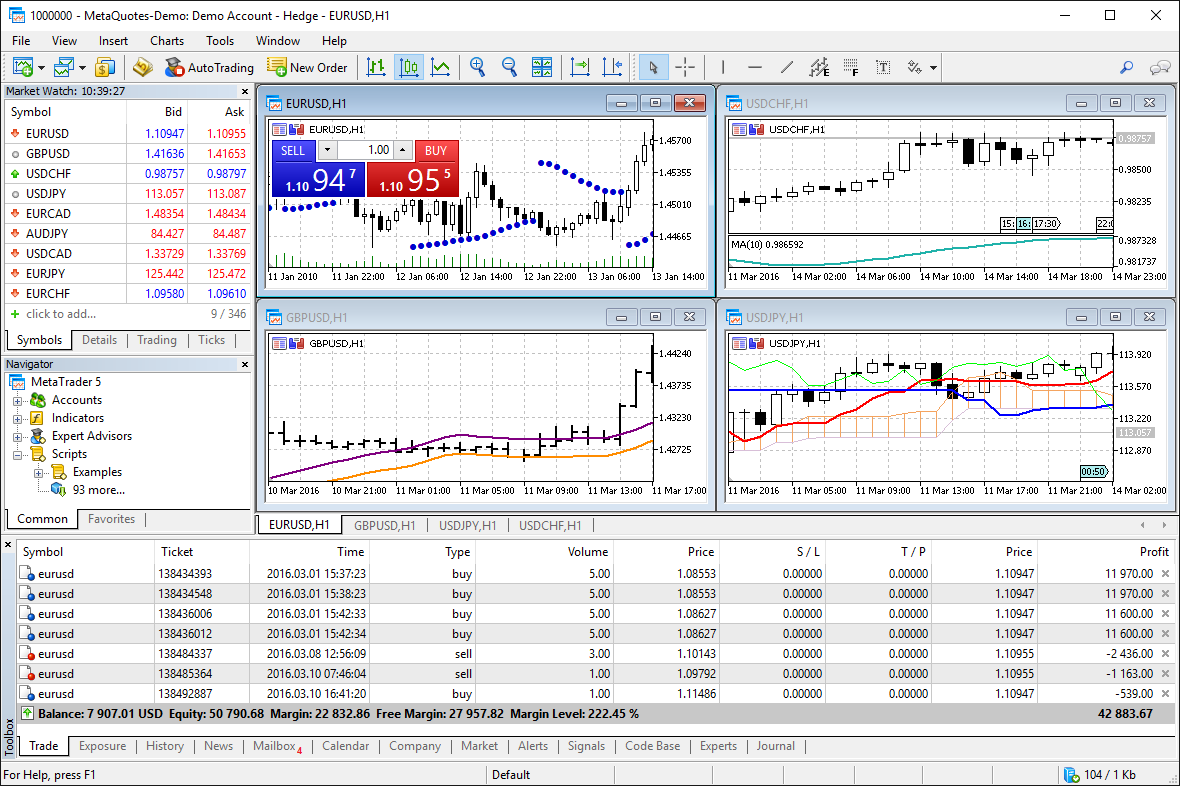

The world of foreign exchange trading is a volatile landscape, where currency fluctuations can swiftly turn potential profits into painful losses. While the allure of high returns attracts many, the risk of unpredictable market movements can be daunting. This is where forex hedges come in, acting as a crucial shield against adverse currency movements and protecting your hard-earned profits.

This article delves into the world of forex hedges, exploring five powerful strategies that can transform you from a passive observer to an empowered trader. We’ll discuss the mechanics of each hedge, their strengths and weaknesses, and how to effectively implement them in your trading plan.

Understanding the Basics: What is a Forex Hedge?

A forex hedge is a strategy designed to mitigate the risk associated with currency fluctuations. It involves taking a position in a financial instrument that offsets the potential losses from your primary investment. Imagine you’re a US-based trader who’s invested in a Japanese stock. If the Japanese Yen weakens against the US Dollar, your investment will lose value. A forex hedge would involve taking a position that benefits from the Yen’s depreciation, thereby offsetting the losses from your stock investment.

Why Hedge?

The primary reasons for employing forex hedges are:

- Risk Mitigation: Hedging helps reduce the potential for losses arising from unfavorable currency movements. This allows traders to focus on their primary investment strategy without being overly concerned about currency fluctuations.

- Profit Protection: By safeguarding your existing profits, hedges enable you to hold onto your gains even if the market moves against you. This can be particularly beneficial in volatile markets or during periods of economic uncertainty.

5 Powerful Forex Hedges to Consider:

1. Forward Contracts:

Forward contracts are agreements between two parties to exchange a specific currency at a predetermined rate on a future date. This allows traders to lock in a specific exchange rate, regardless of how the market moves.

Example: A US-based trader buys a forward contract to sell Euros at 1.10 USD/EUR in three months. If the Euro weakens to 1.05 USD/EUR by the contract’s maturity, the trader still receives 1.10 USD/EUR for every Euro sold, protecting their profits from the currency depreciation.

- Predetermined exchange rate: Provides certainty and eliminates the risk of unfavorable currency fluctuations.

- Flexible maturity dates: Contracts can be tailored to specific trading needs and time horizons.

Cons:

- Limited flexibility: Once the contract is entered, the exchange rate is fixed, leaving no room for potential gains if the market moves favorably.

- Counterparty risk: There’s a risk that the counterparty may default on the contract, resulting in potential losses.

2. Futures Contracts:

Similar to forward contracts, futures contracts involve an agreement to exchange currencies at a predetermined rate on a future date. However, futures contracts are standardized and traded on exchanges, offering greater liquidity and transparency.

-

Example: A US-based trader buys a futures contract to sell Japanese Yen at 110 JPY/USD in six months. If the Yen strengthens to 105 JPY/USD by the contract’s maturity, the trader still receives 110 JPY/USD for every Yen sold, protecting their profits from the Yen’s appreciation.

-

Pros:

- Standardized and liquid: Offers greater flexibility in terms of trading and exit strategies.

- Reduced counterparty risk: Traded on exchanges, reducing the risk of counterparty default.

-

Cons:

- Margin requirements: Futures contracts require margin deposits, which can tie up capital.

- Price fluctuations: Futures prices can fluctuate significantly, potentially resulting in losses.

3. Currency Options:

Currency options give traders the right, but not the obligation, to buy or sell a specific currency at a predetermined price on or before a specific date. This provides flexibility and downside protection without sacrificing potential upside gains.

-

Example: A US-based trader buys a call option on the Euro with a strike price of 1.10 USD/EUR. If the Euro strengthens to 1.15 USD/EUR, the trader can exercise the option and buy Euros at the strike price of 1.10 USD/EUR, locking in a profit. If the Euro weakens, the trader can simply let the option expire worthless.

-

Pros:

- Limited downside risk: The maximum loss is limited to the premium paid for the option.

- Potential for upside gains: Allows for profit potential if the market moves favorably.

-

Cons:

- Premium cost: Options have a time value that decays over time, potentially reducing the overall return.

- Complexity: Understanding options strategies can be complex, requiring a deep understanding of option pricing models.

4. Currency Pairs:

Trading currency pairs allows traders to profit from the relative movement of two currencies. By going long on one currency and short on another, traders can capitalize on the difference in their exchange rates.

-

Example: A trader buys EUR/USD, which means they are buying Euros and selling US Dollars. If the Euro strengthens against the US Dollar, the trader makes a profit.

-

Pros:

- Diversification: Currency pairs offer diversification within the forex market, reducing overall risk.

- Potential for high returns: Currency pairs can offer significant profit potential with leveraged trading.

-

Cons:

- Volatility: Currency pairs can be highly volatile, leading to potentially large losses.

- Correlation: The movement of currency pairs is often correlated, which can limit profit opportunities.

5. Currency ETFs:

Currency exchange-traded funds (ETFs) track the performance of specific currencies or baskets of currencies. This provides investors with a convenient way to gain exposure to foreign exchange markets without the need for direct trading.

-

Example: A US-based investor buys shares of a Euro ETF to gain exposure to the Euro’s performance against the US Dollar.

-

Pros:

- Diversification: ETFs provide diversified exposure to multiple currencies.

- Liquidity and accessibility: ETFs are traded on exchanges, offering high liquidity and ease of access.

-

Cons:

- Fees: ETFs typically charge management fees, which can impact overall returns.

- Tracking error: ETFs may not perfectly track the underlying currency performance, leading to some tracking error.

Choosing the Right Hedge for You:

The optimal hedge for your specific situation depends on several factors, including:

- Your investment strategy: What is your primary investment goal, and what level of risk are you comfortable with?

- Your risk tolerance: How much potential loss are you willing to accept?

- Your trading experience: Are you a beginner or an experienced trader?

- Market conditions: What is the current volatility of the market, and what are the anticipated future trends?

Key Considerations for Effective Hedging:

- Understanding the market: Before employing any hedge, it’s essential to thoroughly understand the market dynamics and the potential risks involved.

- Proper timing: Hedging should be implemented strategically, taking into account the current market conditions and your trading objectives.

- Diversification: Combining multiple hedging strategies can help reduce overall risk and enhance your portfolio’s resilience.

- Monitoring and adjustment: It’s crucial to monitor your hedges regularly and adjust them as needed based on market movements and changes in your investment strategy.

Conclusion:

Forex hedges are a powerful tool for managing risk and protecting profits in the volatile world of foreign exchange trading. By carefully considering your investment strategy, risk tolerance, and market conditions, you can choose the most suitable hedging strategy to safeguard your investments and maximize your trading potential. Remember, hedging is not a guarantee against losses, but a strategic approach to mitigate risk and enhance your overall trading experience. With the right knowledge and application, forex hedges can become your ultimate weapon for navigating the ever-changing currency landscape.

- Predetermined exchange rate: Provides certainty and eliminates the risk of unfavorable currency fluctuations.

- Flexible maturity dates: Contracts can be tailored to specific trading needs and time horizons.

Cons:

- Limited flexibility: Once the contract is entered, the exchange rate is fixed, leaving no room for potential gains if the market moves favorably.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Weapon: 5 Forex Hedges to Safeguard Your Profits. We hope you find this article informative and beneficial. See you in our next article!